Utah hits home-buying, construction stimulus cash bonanza

Utah hits home-buying, construction stimulus cash bonanza

Economy » One grant went toward a $700,000 house.

By Robert Gehrke, The Salt Lake Tribune

Updated: 04/28/2009 07:31:58 AM MDT

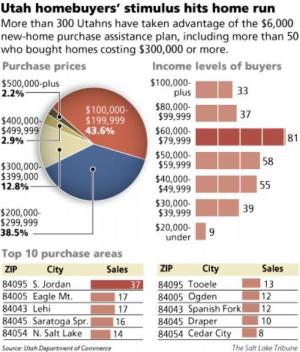

Home builders say a state grant program designed to entice Utahns to buy new homes is working, with people flocking to take advantage of the $6,000 incentive and creating a demand that they hope will get the construction industry moving again.

To date, the Home Run Program has awarded more than 530 grants to homebuyers, about $3.2 million in all. But not all of the grants are going to prospective homeowners who are scraping together money to buy a house.

In fact, there is no limit on the price of homes that qualify for the program. As a result, a handful of the 312 taxpayer-funded grants awarded in the first month have gone to help buy homes worth more than $500,000, with one home purchased for more than $700,000. The

In fact, there is no limit on the price of homes that qualify for the program. As a result, a handful of the 312 taxpayer-funded grants awarded in the first month have gone to help buy homes worth more than $500,000, with one home purchased for more than $700,000. TheUtah Housing Corp. provided a breakdown of grants in the program's first month. Another 219 grants were awarded in the past two weeks.

"Is that the best use of public funds?" asks Steve Graham, director of the Utah Community Reinvestment Coalition. "Obviously the Legislature and the governor felt it was. I focus on affordable housing, so certainly we would have loved to see that kind of funding go to low- and moderate-income homes."

But, Graham said, the program was aimed at recharging the construction industry, not helping people afford a home. In that sense, he thinks the program will probably prove beneficial.

And backers say the Home Run program is paying early dividends, with developers seeing increased salesand one real estate expert, Ivy Zelman of Zelman & Associates in New York, picking Utah as the No. 1 market in the country poised to recover from the housing slump, in part because of the grants.

"The response has been overwhelming," said Curt Dowdle, executive officer with the Salt Lake Homebuilders Association. "It's been the single greatest stimulus that the local homebuilders have had."

The program which started March 16 uses $10 million of federal stimulus money to provide $6,000 grants to individuals buying never-lived-in homes to get those houses off the market and create demand for construction, an industry that has lost 18,000 jobs during the recession.

The state grant can be combined with a federal tax rebate of $8,000 for first-time homebuyers. Some builders also are adding their own incentives.

A study by University of Utah economist James Wood said the demand created by the program would put an estimated 8,800 people to work.

Not surprisingly, the bulk of the grants have been awarded to homes in the suburbs and exurbs, which were Ground Zero for the housing construction boom in the early half of the decade.

One in six of the homes qualifying for the grants were in South Jordan, West Jordan or Herriman. Another 17 percent were purchased in Eagle Mountain, Lehi, Saratoga Springs or American Fork.

One in six of the homes qualifying for the grants were in South Jordan, West Jordan or Herriman. Another 17 percent were purchased in Eagle Mountain, Lehi, Saratoga Springs or American Fork.Echo Hall said the $6,000 in assistance was "huge" for her when she bought her South Jordan townhome.

"It just made it all possible for me, because I was really struggling to find an existing place that I loved and was in a good location for the right price," she said.

Kim Hagedorn said she had already made the decision to buy her new home in the Daybreak community and was about to close when the Home Run program kicked in. She used the $6,000 to pay her closing costs, rather than roll them into her loan.

"It was just perfect timing," she said.

More than 80 percent of the Home Run-qualifying homes were bought for less than $300,000. But a handful -- sixteen of the 312 grants awarded in the first month -- went to homes worth more than $400,000.

The Utah Housing Corp. would not provide details on those purchases, citing federal privacy laws.

Wood's study found that 400 of the 2,900 surplus new homes on the market were priced at more than $500,000. In those cases, says Wood, the enticement of $6,000 is probably marginal. "I would think, though, for those several hundred under $300,000, it was very important," he said.

"That is a little difficult to swallow. I think people, their eyebrows should rise a little bit," said Graham of those unusual cases where the grant was given to high-priced homes.

Sen. Wayne Neiderhauser, R-Sandy, who was on the committee that formulated the program, said there was discussion of putting a $400,000 cap on the value of the home prices. That was ultimately abandoned in favor of income limitations of $75,000 per person or $150,000 per household.

But homeowners who have equity in their existing home could sell and get the grant if they want to upgrade.

"We knew there might be a couple of the outliers," said Niederhauser, "but we weren't that concerned as long as the bulk of the homes were in range of the target we had."

Dowdle, of the Homebuilders group, said that, in hindsight, some price restrictions probably would have been helpful.

"I think [the Legislature's] intent was to apply it to people who really needed the help," he said. "I think there are some cases where this grant didn't really go to people who needed it. But you've still stimulated a transaction."

Labels: Utah economic development, Utah economy, Utah market, Utah recognitions

0 Comments:

Post a Comment

<< Home